Abstract

This report analyses current Large Language Models (LLMs) and their

application in generating three-dimensional models and physical objects. The

intersection of generative AI and 3D content creation represents a rapidly

evolving market with implications for manufacturing, design, gaming, and e-

commerce industries. Through analysis of current market players, technologi-

cal capabilities, and strategic positioning, this report evaluates the competitive

landscape using Porter’s Five Forces. A practical demonstration using Hy-

per3D Rodin Gen-2 validates the current state of technology and its readiness

for real-world applications, including 3D printing. The findings reveal that

while the technology has achieved production-ready quality for creative appli-

cations, significant post-processing remains necessary for functional additive

manufacturing use cases.

Introduction

Motivation

My motivation for this topic comes mainly from my hobby: 3D printing. After my

bachelor studies, I had free time and wanted to learn something new, so I bought

a Prusa 3D FFF printer(Prusa Research, 2025) and started learning how to use it

from various online tutorials and online forums. Currently, I mostly print models

from others, as I still have not had enough time to learn various modeling tools, such

as Fusion 360, to create my own models. Thus, I wanted to research the current

text and image to a 3D model landscape and find out what current LLM models

can do and whether they could supplement my knowledge gap.

Background and Context

Text-to-3D and image-to-3D generation have emerged as fast-growing segments in

generative AI, with the market valued at $1.28–1.63 billion in 2024 and projected

to reach $9–16 billion by 2032–2033(Growth Market Reports, 2024).

This technology fundamentally changes how 3D content can be generated, re-

ducing what once took professional modelers’ days of manual work to minutes. This

rapid evolution has createda place where established technology companies, new star-

tups, and open-source communities compete for the growing market.

Key Intelligence Questions

This report addresses two primary Key Intelligence Questions (KIQs):

- What is the current state of LLM-based 3D generation technology, and can it

supplement traditional 3D modeling skills for hobbyist applications? - How do competitive dynamics shape strategic opportunities in this market?

The scope of the report includes text-to-3D and image-to-3D generation tools

and models. Various other photogrammetry, CAD, and 3D scanning solutions are

excluded from the analysis.

Methodology

This analysis employs multiple competitive intelligence methodologies. For informa-

tion gathering, I used primary sources including company documentation, API spec-

ifications, pricing pages, and product announcements. Secondary sources included

various industry reports, technology news outlets, and user community forums. I

also applied Porter’s Five Forces analysis (Porter, 2008) to evaluate the current in-

dustry and market structure. Finally, I attempted to create a practical model using

Hyper3D Rodin Gen-2.

Theory

3D Generation Technologies

Several foundational techniques underpin modern 3D generation. Score Distillation

Sampling (SDS), introduced by DreamFusion (Poole, Jain, Barron, & Mildenhall,

2022), enables 3D generation without 3D training data by optimizing a Neural Ra-

diance Field (NeRF) such that its 2D renderings achieve high likelihood under a pre-

trained diffusion model. NeRFs themselves represent scenes as continuous volumet-

ric functions encoded in neural network weights, producing high-quality novel views

but requiring slow per-scene optimization (Mildenhall et al., 2020). More recently,

3D Gaussian Splatting (3DGS) has shifted toward explicit representations using mil-

lions of parameterized Gaussians, enabling real-time rendering at 90+ FPS—roughly

10× faster than NeRF—at the cost of larger memory requirements (Kerbl, Kopanas,

Leimkühler, & Drettakis, 2023).

Large Reconstruction Models

Large Reconstruction Models (LRMs) have become the dominant architecture for

commercial tools. These transformer-based encoder-decoders with 500M+ param-

eters predict 3D representations from single images in seconds. GS-LRM achieves

reconstruction in 0.23 seconds from 2–4 images (Bi et al., 2024). Commercial ex-

amples include Hyper3D’s Rodin Gen-2, which scales to 10 billion parameters, and

Tripo 3.0, which reaches 20 billion parameters. These models accept both text and

image inputs and produce 3D mesh files (such as .stl or .obj) as outputs.

Competitive Analysis

Market Overview

The text-to-3D generation market demonstrates strong growth fundamentals driven

by several factors: the democratization of 3D content creation for non-technical

users, cost reduction in game development and visual effects production, e-commerce

adoption of 3D product visualization, and integration with AR/VR platforms and

spatial computing (Growth Market Reports, 2024; Market.us, 2024; Allied Market

Research, 2025).

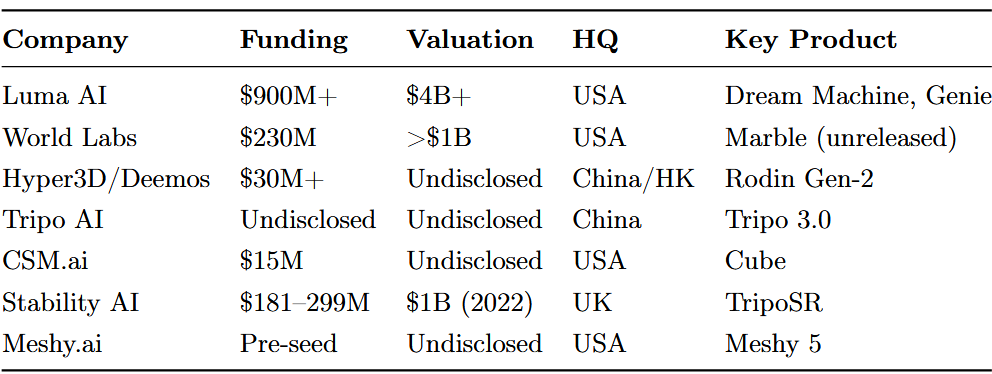

Key Players and Competitive Landscape

The competitive landscape divides into three tiers: well-funded leaders, emerging

specialists, and research-focused organizations. Table 1 summarizes key player char-

acteristics.

Table 1: Overview of Key Players in LLM-Based 3D Generation (Author’s own work)

Geographic distribution shows concentration in the United States (Luma AI,

World Labs, CSM.ai), China (Hyper3D, Tripo AI), and the United Kingdom (Sta-

bility AI). North America leads the market, followed by Europe and Asia Pacific,

with the latter experiencing the fastest growth driven by expanding gaming and

animation industries (Growth Market Reports, 2024).

Luma AI has emerged as the funding leader after closing a $900 million Series C

in November 2025 led by Saudi Arabia’s HUMAIN, achieving a valuation exceeding

$4 billion (Tech Startups, 2025). Based in Palo Alto with 25+ million registered

users, Luma focuses on 3D scanning (Genie) and video generation (Dream Machine).

Hyper3D/Deemos Tech represents China’s most significant player, having

raised tens of millions of dollars in a January 2025 Series A led by ByteDance

and Meituan (Animation World Network, 2024). The company’s Rodin Gen-2

Competitive Intelligence Report LLMs and 3D Model Generation

model (10 billion parameters) is widely regarded as current quality leader, producing

production-ready models.

Tripo AI has achieved profitability with $12 million in revenue and serves 4 mil-

lion users (Yahoo Finance, 2024). The company’s open-source TripoSR model (de-

veloped with Stability AI) achieves generation in under 0.5 seconds on an NVIDIA

A100 (Stability AI, 2024).

Meshy.ai has captured the prosumer market with 3+ million creators and com-

prehensive integrations across Unity, Unreal Engine, Blender, Maya, and 3D printing

platforms (Meshy AI, 2024).

Porter’s Five Forces Analysis

Threat of New Entrants: MODERATE-HIGH

Open-source models such as TripoSR and Hunyuan3D reduce technical barriers by

providing MIT-licensed alternatives (Stability AI, 2024; VAST-AI-Research, 2024).

However, significant barriers remain: large-scale 3D training datasets are scarce—Autodesk’s

Project Bernini was trained on ten million diverse 3D shapes, described as the

world’s largest 3D training dataset (Autodesk, 2024)—and foundation model train-

ing requires substantial compute investment.

Bargaining Power of Suppliers: HIGH

Key suppliers include cloud compute providers and GPU manufacturers (primarily

NVIDIA). NVIDIA’s dominance creates concentration risk—according to Mizuho

Securities, NVIDIA controls 70–95% of the AI chip market (Novet, 2024).

Bargaining Power of Buyers: MODERATE-HIGH

Low switching costs between similar tools increase buyer power, while freemium

models intensify competition. However, ecosystem lock-in through various API and

enterprise plugins reduces switching for deeply integrated users and companies.

Threat of Substitutes: LOW-MODERATE

Substitutes include traditional 3D modeling software (Blender, Maya), photogram-

metry, and outsourced modeling services. AI generation complements rather than

fully replaces traditional workflows—professional outputs still require artist refine-

ment.

Industry Rivalry: HIGH

Currently, the industry is characterized by rapid product iteration and aggressive

pricing through expanding free tiers. There is currently no clear absolute winner

among the players competing in the market.

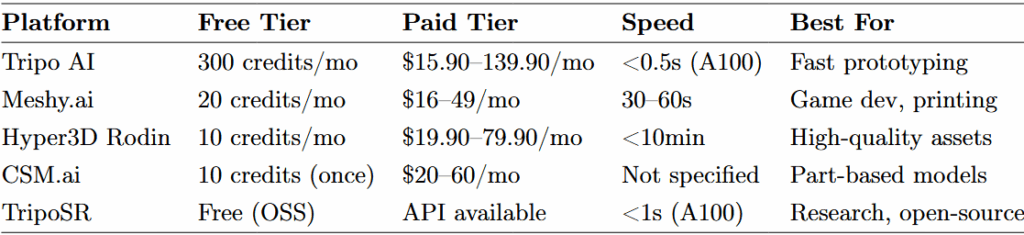

Technology Comparison

Table 2: AI 3D Generation Platforms: Pricing and Features (Author’s own work)

Industry Applications

To understand where the market is heading, I examined adoption patterns across

key industries, which also informed my choice of tool for practical testing.

Gaming leads adoption with 87% of game studios now using generative AI tools

(MIT Technology Review, 2024). The AI gaming market exceeded $3.28 billion in

2024 and is projected to reach $27.47 billion by 2029 (Technavio, 2024). The 2024

Unity Gaming Report indicates 62% of developers are using AI tools, with 68%

reporting that AI accelerates prototyping (Unity Technologies, 2024).

Manufacturing applications center on generative design optimization. Au-

todesk’s Fusion 360 and newly announced Neural CAD foundation models generate

manufacturable design iterations based on material and cost constraints (Autodesk,

2024).

Film and VFX applications include tools like Autodesk Flow Studio, which

transforms live footage into editable CG scenes (The Hollywood Reporter, 2024).

Practical Example

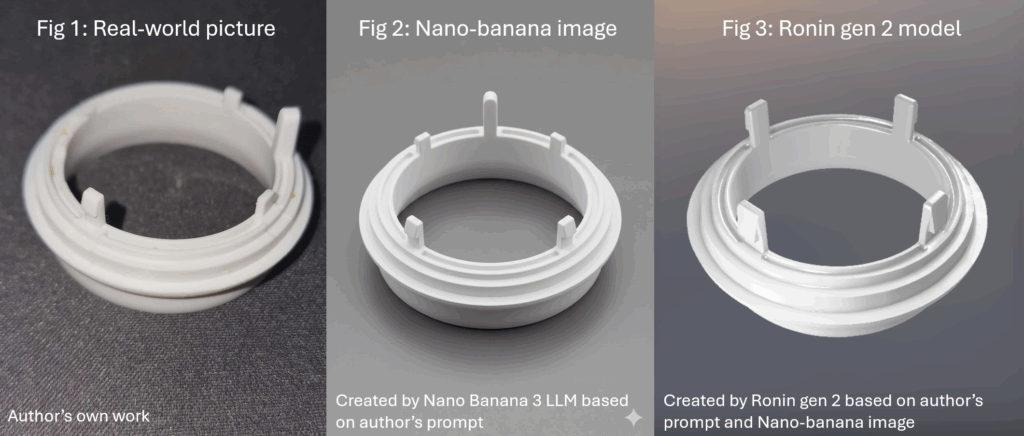

As noted in the section 1.1, I wanted to test out a model from the underlying analysis

to test out its capabilities and find out whether these tools can supplement my lack

of knowledge in 3D modelling.

I chose Hyper3D Rodin Gen-2 based on my analysis, as it has the highest quality

ceiling among analyzed models, generation time was not critical for my use case, and

its free tier (10 credits/month with preview capability) is competitive. I considered

Meshy.ai for its 3D printing integration but lower quality ceiling, Tripo AI for speed

but less manufacturing suitability, and open-source TripoSR which requires technical

setup I wanted to avoid.

Methodology

I attempted to recreate a damaged part of my kitchen grater, following a workflow

from user guides on how to achieve the best results with LLM-generated models for

3D printing (3D Revolution, 2025):

- Reference Preparation: I took eight photos of the broken object and up-

- loaded them to Google’s image generation model to create a complete reference

- image of the undamaged part. Prompt: “Can you please generate me an image of the complete model for later generation of

- a model file? Where there were 5 legs total, 4 of the smaller ones were identically spaced and were

- identical, 3 of the legs broke partially or fully. The last leg (long) is correct in the model. The full

- diameter of the model is 49.80mm, and the 4 identical legs are 6.75mm from the outer perimeter”

- 3D Generation: I uploaded the reference image to Hyper3D Rodin Gen-2

- with a descriptive prompt. Prompt: “White plastic circular ring with tabs. it has 5 tabs in total 4 smaller ones and one

- larger one.”

- Post-Processing: I exported the model as .stl and repaired geometry issues

- using Windows 11’s built-in mesh repair.

- Printing: I prepared the part in PrusaSlicer and printed it on my FFF printer.

Results

Figure 1–3: Images used for the part creation

Following through the workflow took me several hours on the first attempt. The

most critical factor proved to be prompt design. The model responded inconsistently

to detailed specifications. Thankfully using the preview feature, I could iterate on

prompts without consuming credits, as until you confirm the preview no mesh model

is generated in full.

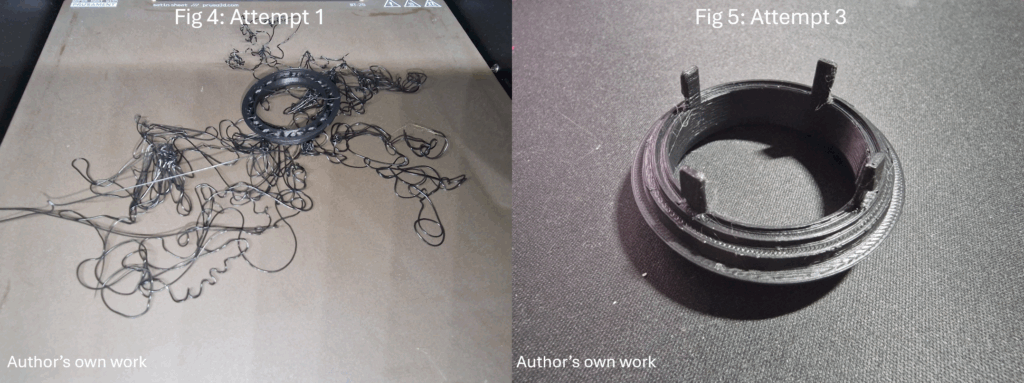

Figure 4–5: Pictures of the part creation attempts

The final part required three print attempts (each 25 minutes) to achieve a

proper fit. Despite explicit prompting, Rodin consistently failed to capture the

missing fifth leg—a limitation I could not overcome through prompt refinement

alone. The printed part ultimately fit its intended purpose after manual cleanup

with a deburring knife.

Evaluation

My practical test revealed both capabilities and limitations relevant to my original

question.

What worked: The tool successfully generated a functional model from photos

and text descriptions. Basic geometry was captured surprisingly well, and I feel like

it got me 90% there.

What did not work: Precise dimensional specifications were ignored. Complex

features (the fifth leg) could not be generated regardless of prompting, and post-

processing was still necessary for functional fit.

Intellectual Property Concerns: During my analysis, I examined Hyper3D’s

terms of service (Hyper3D.ai, 2025). The terms do permit commercial use of the

generated models, but they do not mention any IP rights, only saying that they take

no responsibility for any copyright infringement or breach of laws resulting from user

use of the output.

Subscription Practices: I also noticed that Hyper3D’s free trial requires credit

card details, with terms stating “Upon payment, the Subscription Plan chosen by

you cannot be canceled or downgraded within the corresponding subscription period,

potentially resulting in a $280 annual charge. I reached out to the support page

regarding this, as I wanted to try out the better features and more credits that

come with a subscription before possibly purchasing the service, but they did not

get back to me.

Conclusions

Addressing the Key Intelligence Questions

KIQ 1: Can LLM-based 3D generation supplement traditional modeling

skills?

Based on my research and practical testing, the answer is: partially. For creative,

non-functional objects (game assets, decorative items), current tools do significantly

accelerate workflows. For functional parts requiring dimensional accuracy, the tech-

nology cannot yet replace traditional modeling skills. In my case, I would have

definitely achieved better results by learning basic Fusion 360 operations than by

iterating on AI prompts.

Based on my experience, these tools currently enhance productivity for creative

work but cannot replace modeling expertise for functional applications. Users with

traditional modeling experience will produce superior results when using AI tools.

KIQ 2: How do competitive dynamics shape strategic opportunities?

The market is very dynamic and currently has crystallized around distinct com-

petitive positions: Hyper3D leads in quality, Tripo AI in speed, Luma AI in fund-

ing, and Meshy.ai in ecosystem integration. High industry rivalry and low switching

costs benefit users through aggressive free tiers, but also create uncertainty about long-term platform viability. The open-source ecosystem (TripoSR, Hunyuan3D)

provides alternatives for technically capable users.

Summary of Findings

This competitive intelligence analysis reveals several key findings:

- The text-to-3D market is transitioning from research curiosity to production

technology, with leading company valuations exceeding $4 billion. - Large Reconstruction Models (LRMs) and 3D Gaussian Splatting have emerged

as dominant technical approaches, enabling sub-second draft generation. - Gaming leads industry adoption with 87% studio usage. E-commerce and

manufacturing applications are accelerating. - For 3D printing applications, significant post-processing remains necessary—my

practical test confirmed that functional parts require manual intervention re-

gardless of prompt sophistication.

Limitations and Future Research

This analysis is limited by the rapidly evolving competitive landscape, limited access

to proprietary benchmarks, and single-tool practical validation (Hyper3D Rodin).

Future research directions could include long-term tracking of these technologies, the

IP question with these generated models, and the viability of commercially selling

products created by these technologies.

Declaration of AI Tool Usage

In accordance with academic integrity requirements, the following AI tools were

used in the preparation of this report:

Perplexity (Perplexity AI): Used along with Google dorking for a breadth-

wide search of the current landscape and possible sources with the goal of

mapping the analyzed landscape and identify the most relevant sources

- NotebookLM (Google) and Claude (Anthropic): Used for initial re-

search assistance and source identification. The content generated and pin-

pointed to by these models was verified and evaluated against the primary

sources. The abstract and final summary of findings sections of this report are

an AI-aided summary of the report’s content and were the last part I created. - Nano Banana 3 (Google): Used for a initial 2D image generation in the

example part of the section 5 - Hyper3D Rodin Gen-2: Used for a practical example of image/text-to-3D

capabilities as documented in Section 5. - Grammarly AI: Used for the final validation of the grammar of the report

All claims, analyses, and conclusions represent my own work and critical judgment.

Reference

3D Revolution. (2025). A.I. generated 3D prints are good now? YouTube video. Re-

trieved from https://www.youtube.com/watch?v=j1nT2WKWYPk. (Accessed

November 2025)

Allied Market Research. (2025). Spatial computing market to reach USD

1061 billion by 2034. Retrieved from https://finance.yahoo.com/

news/spatial-computing-market-reach-usd-140100252.html. (Accessed

November 2025)

Animation World Network. (2024). Deemos launches groundbreak-

ing Rodin Gen-2 GenAI for intuitive 3D creation. Retrieved from

https://www.awn.com/news/deemos-launches-groundbreaking-rodin

-gen-2-genai-intuitive-3d-creation. (Accessed November 2025)

Autodesk. (2024). Autodesk unveils research Project Bernini for generative AI 3D

shape creation. Retrieved from https://adsknews.autodesk.com/en/news/

research-project-bernini/. (Accessed November 2025)

Bi, S., Xu, Z., Tan, H., Zhang, K., Zhe, C., Luan, F., . . . Bi, S. (2024). GS-

LRM: Large reconstruction model for 3D gaussian splatting. https://sai-bi

.github.io/project/gs-lrm/. (Accessed November 2025)

Growth Market Reports. (2024). Text-to-3D generation market research report

- Retrieved from https://growthmarketreports.com/report/text-to

-3d-generation-market. (Accessed November 2025)

Hyper3D.ai. (2025). Terms of service. Retrieved from https://hyper3d.ai/legal/

terms. (Accessed November 2025)

Kerbl, B., Kopanas, G., Leimkühler, T., & Drettakis, G. (2023). 3D Gaussian

Splatting for real-time radiance field rendering. ACM Transactions on Graph-

ics (SIGGRAPH). (Introduced 3D Gaussian Splatting technique)

Market.us. (2024). 3D e-commerce market size, share | CAGR of 21.3%. Re-

trieved from https://market.us/report/3d-e-commerce-market/. (Ac-

cessed November 2025)

Meshy AI. (2024). Meshy AI – the #1 AI 3D model generator. Retrieved from

https://www.meshy.ai/. (Accessed November 2025)

Mildenhall, B., Srinivasan, P. P., Tancik, M., Barron, J. T., Ramamoorthi, R., &

Ng, R. (2020). NeRF: Representing scenes as neural radiance fields for view

synthesis. In Proceedings of the european conference on computer vision (eccv).

(Foundational Neural Radiance Fields paper)

MIT Technology Review. (2024). How generative AI could reinvent what it means

to play. Retrieved from https://www.technologyreview.com/2024/06/20/

1093428/generative-ai-reinventing-video-games-immersive-npcs/. (Reports a16z 2023 survey finding 87% of game studios using AI. Accessed

November 2025)

Novet, J. (2024). Nvidia dominates the AI chip market, but there’s more

competition than ever. CNBC. Retrieved from https://www.cnbc.com/

2024/06/02/nvidia-dominates-the-ai-chip-market-but-theres-rising

-competition-.html. (Mizuho Securities estimates NVIDIA controls 70–95%

of AI chip market. Accessed November 2025)

Poole, B., Jain, A., Barron, J. T., & Mildenhall, B. (2022). DreamFusion: Text-to-

3D using 2D diffusion. arXiv preprint arXiv:2209.14988 . (Foundational paper

introducing Score Distillation Sampling for text-to-3D)

Porter, M. E. (2008). The five competitive forces that shape strategy. Harvard Busi-

ness Review , 86 (1), 78–93. (Foundational competitive strategy framework)

Prusa Research. (2025). Types of printers and their differences. Prusa Knowl-

edge Base. Retrieved from https://help.prusa3d.com/article/types-of

-printers-and-their-differences_112464. (Accessed November 2025)

Stability AI. (2024). Introducing TripoSR: Fast 3D object generation from

single images. Retrieved from https://stability.ai/news/triposr-3d

-generation. (MIT license, developed in partnership with Tripo AI. Accessed

November 2025)

Tech Startups. (2025). Luma AI lands $900M led by Saudi Arabia’s HUMAIN

to challenge OpenAI and Google with frontier multimodal models. Retrieved

from https://techstartups.com/2025/11/20/luma-ai-lands-900m-to

-challenge-openai-and-google-with-frontier-multimodal-models

-partners-with-humain-on-saudi-arabias-2gw-ai-megacluster/. (Ac-

cessed November 2025)

Technavio. (2024). Artificial intelligence (AI) in games market size to grow by USD

27.47 billion from 2024 to 2029. Retrieved from https://www.technavio

.com/report/ai-in-games-market-industry-analysis. (Market research

report)

The Hollywood Reporter. (2024). For Hollywood, AI is a double-edged sword.

Retrieved from https://www.hollywoodreporter.com/business/business

-news/hollywood-ai-production-vfx-animation-1236086670/. (Accessed

November 2025)

Unity Technologies. (2024). 2024 Unity Gaming Report: Trends, data & expert tips.

Retrieved from https://unity.com/resources/gaming-report-2024. (Re-

ports 62% of developers using AI tools, 68% using AI to accelerate prototyping.

Accessed November 2025)

VAST-AI-Research. (2024). TripoSR: Fast 3D object reconstruction from a single

image. Retrieved from https://github.com/VAST-AI-Research/TripoSR. (MIT License. Accessed November 2025)

Yahoo Finance. (2024). Tripo, the frontrunner of 3D AI boom, supercharges new

era in content creation with 3.0 upgrade. Retrieved from https://finance

.yahoo.com/news/tripo-frontrunner-3d-ai-boom-151500448.html. (Ac-

cessed November 2025)